Note: As a corollary to the post previously written and continuing an effort to understand the current predicament we find ourselves in- I revisited Ray Dalio's (Founder of Bridgewater Associates, the world's largest hedge fund) Economic Principles and the framework espoused therein, to gauge where in the economic cycle we are.

The Ray Dalio Framework

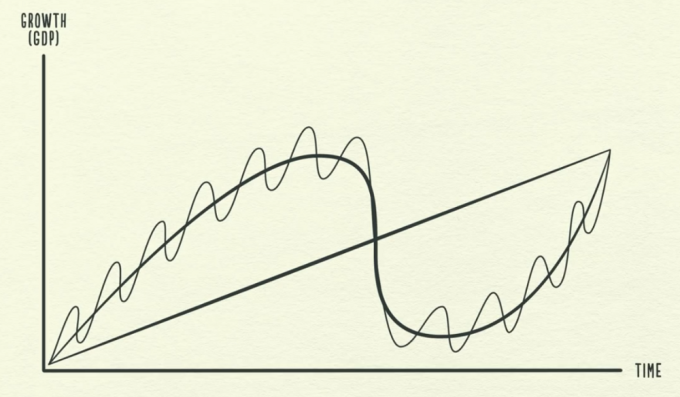

To ascertain where in the economic cycle we are, one must understand the interplay of three concepts (as seen in Figure 1):

- Productivity gains- Denoted by Real GDP per Capita, this has more or less seen a linear progression through the last century.

- Long term debt cycle- Since the times of Old Testament (which also calls for the need to wipe out debt once every 50 years- better known as Jubilee), cycles of credit creation and bust have persisted in our economy. Credit and spending rises faster than income levels which in turn generates higher incomes and networth through increased aggregate demand. This cycle, however, cannot persist forever and as the cost of servicing the debt rises beyond a certain limit, so does the chance of its default. This pushes the economy through a arduous process of deleveraging before the economy is capable of going back into the consumption phase.

- Short term debt cycle- What is commonly known as the business cycle, is primarily controlled by the money supply and velocity in the economy. When rate of spending grows at a faster clip than the economy's ability to produce we witness heightened rates of inflation. To curb this, tighter monetary policies are sanctioned leading to a contraction in the economy. Such recessions end with a reversal in monetary policy in order to stimulate demand, and the cycle replays.

- Figure 1: Interplay of the three concepts

Implications of this Framework

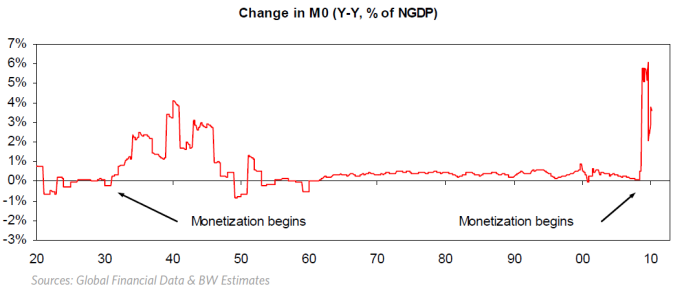

At the very least, viewing the events of this century through the lens of Dalio's framework, exposes the folly of calling the Financial Crisis of 2008-09 a concluded recession. Quantitative easing to the extent we have seen (see Figure 2) in all the developed economies should have been more than enough to spur spending and therefore aggregate demand in a post recession world. This however isn't the case. Deflation and lack of growth are still at the front of every central banker's mind in these economies, as they wallow in the denial of their ineffectiveness to salvage economic growth. It is not monetarists that the world needs now; it is time for the Keynesians to shine.

- Figure 2: Money Supply in USA

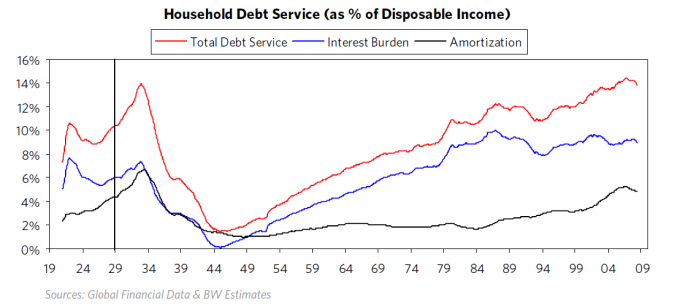

The inability of easy monetary policy in spurring credit growth and the rather high levels of indebtedness in the developed economies indicate a top in the long term debt cycle. When the cash flow crunch causes the deleveraging process to commence is anyone's guess but a look at Figure 3 indicates that it is likely to be sooner than later.

- Figure 3: Household debt service at an all time high in USA

Combating the Implications

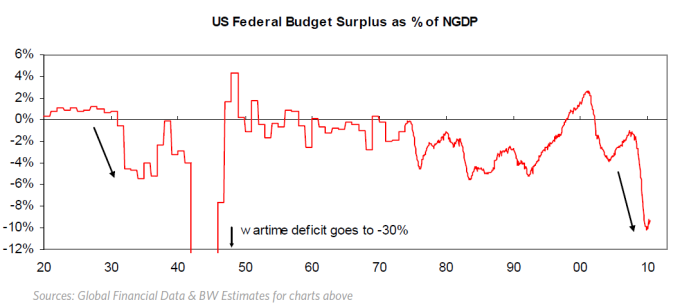

It is imperative to study the methods of combating these implications simply to make an educated guess of the what to expect from government policies across the developed world over the next decade. The debt to income ratio can be tackled down with two sets of policies:

- Deflationary and Recessionary- Debt reduction methods including austerity.

- Inflationary and Stimulative- Debt-monetization and heightened government spending.

While parts of Europe has adopted the former, US seems to be on track to adopt more of the latter. This predicament the economy finds itself in, coupled with the election of Donald Trump has paved the path for the Keynesian thought process of 1930s to take over USA today. This recovery, however, will be a onerous process as infra spend is a long term commitment and current level of debt will raise the difficulty level of the conundrum. Figure 4 however demonstrates a template from the past to help determine our expectations of the future.

- Figure 4: Federal Budget Surplus/ Deficit in USA

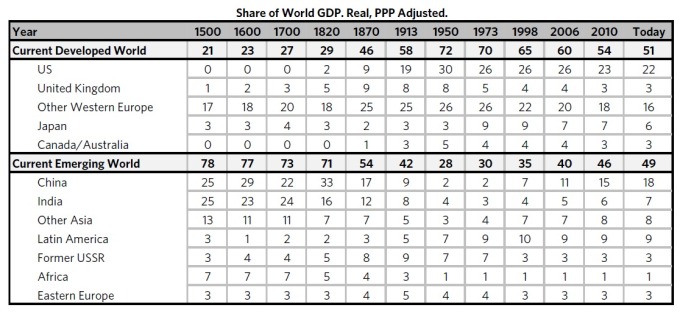

The appendage of fiscal stimulus can only be taken away when we return to normalcy; i.e. "only when capable providers of capital willingly chose to give money to capable recipients of money." For this to occur the populace will go through denial, reluctance to accept lower credit and therefore lower spend levels, acceptance of the new normal, admittance of the fiscal stimulus into their systems and finally ability to run without the appendages again. This elongated deleveraging process will cause a shift in the global economy; the lull period in the developed economies of today will be capitalized. The occurrence of the shift is even more obvious from the Figure 5 below. The developed of the past will become the developed of the future.

- Figure 5: % Share of the World GDP

The Political Cycle Implications

Dalio's framework suggests that there are five stages a country goes through:

- Countries that are poor and think they are poor- Transition from such a stage is gradual and only initiated with minor structural reforms which results in Foreign Direct Investment in the country in order to take advantage of its low cost of production. India's economic liberalization in the early 1990s would be that reform that has transformed the country over the last two decades. Without such reforms countries can be stuck in this phase for a long time.

- Countries that are rich but think they are poor- Such nations are characterized with hard-work, immense amounts of savings as they are unsure of the future and predominantly an export led economy. China in the first decade of this century would be a textbook example of this stage.

- Countries that are rich and know they are rich- With a generation being born into prosperity, without the conditioning of the hardships faced in the previous two stages, countries that find themselves in the higher decile of nations (in terms of per capita GDP), act like it. Their economic prowess enables them to wield significant dominance over global politics. The "American Empire" that "ruled by speaking softly and carrying a big stick" post World War II is a classic specimen of this stage.

- Countries that start becoming poorer but still think of themselves of being rich- Adorned with a phase of leveraging, debts start piling up as income levels do not support the spending sustained in the earlier state of 'richness'. The end days of this stage are denoted by repeated asset bubbles. In hindsight, the first decade of the 21st century in the US which witnessed two massive bubbles- tech bubble in 2000-01 and financial crisis of 2008-09 is likely an example of such a case. Britain between the two world wars would also fit in with this stage.

- Deleveraging- With the growing imbalance between credit fueled spending and income, great countries and nation empires of the past go through a phase of decline and those in stage 3 at the time take over from them.

Dalio's framework of long-term debt cycle leads us to a similar political conclusion for the future of this world as discussed in the previous post. His framework however enables us to better understand the progression from today, to that conclusion while giving us a reasonable guesstimate for a timeline that can be deduced upon using his template.

Note: To further understand Dalio's framework read his book titled Economic Principles. The link for the same can be found here.

No comments:

Post a Comment